China Calls on Major Central Banks to Hold Interest Rates

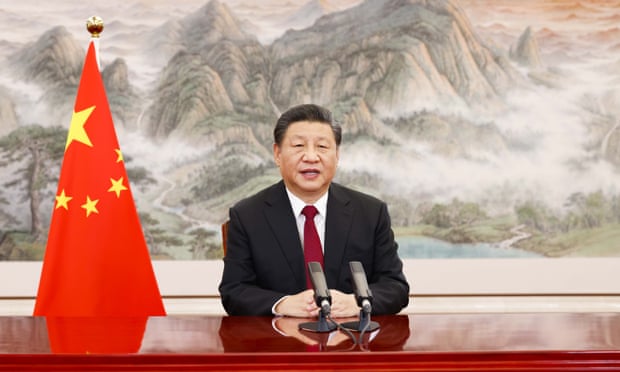

Chinese President Xi Jinping appealed directly to major central bank bosses to resist increasing interest rates to ensure global financial stability.

Speaking this week at a World Economic Forum event, China’s leader asked major world economies to instead work in coordinated ways to fight inflation and stave off another economic downturn.

Highlighting the major economic threats of the day, Xi said, “The global industrial chains and supply chains have been disrupted. Commodity prices continue to rise. Energy supply remains tight. These risks compound one another and heighten the uncertainty about economic recovery.”

China has followed Xi’s words by keeping its own primary interest rate unchanged. The country recently reduced two key rates – the reserve requirement ratio that guides how much cash reserves banks need, and the loan prime rate, the level at which commercial banks lend to premium customers.

Some of the most important central banks have recently made moves to tackle rising inflation. The US Fed and the Bank of England have both signaled their intention to raise interest rates, while the European Central Bank finally announced it would end its pandemic-era bond-buying program in March.

What does this mean for me?

China was the only major world economy to grow in 2020, the first year of the COVID-19 pandemic. China’s economy also grew in 2021 by 8.1%.

Rather than concentrating on its own fortunes, the country is appealing to the world to act in collective interest. This, if anything, shows you as a trader how interconnected the world economy is and how it should be viewed holistically.

More News

.webp)

Canada Shields Steel and Lumber Industries From Tariffs

Trump Drops Selected Tariffs in Response to Inflation Pressures

Tariffs on Mexico Test Nuevo Leon’s Industrial Momentum

US Moves to Ease Latin American Tariffs as Food Inflation Mounts

Japan Faces First GDP Shrinkage in Six Quarters as Tariffs Bite

India’s Inflation Dip Strengthens Case for RBI Easing

Europe Rallies as Shutdown Eases, Earnings Impress