How US National Debt Impacts Your Investments

It’s hard to comprehend how much money $36 trillion is. That's the US national debt as of 2025, which has significant implications for that government and its economy. It also has major implications for your personal investments across various asset classes. With the US economy the largest in the world, events in the US financial landscape have repercussions around the globe, regardless of whether you live there and use a US-based broker, or you don’t.

Of course, the national debt in any country affects its trading environment, but, owing to the size and influence of the US economy, its impacts are outsized. National debt influences everything from interest rates to market stability. Being informed about its effects can help you make more strategic investment decisions.

Our experts at Arincen will try to unpack the interrelated dynamics of the US national debt and how it affects retail traders. Whether you deal in stocks, bonds, ETFs, FOREX, commodities, or cryptocurrencies, the impacts are far-reaching and can be pivotal to your trading strategy and financial health.

By the end of this article, you will understand how the national debt can influence various aspects of your investment portfolio and how to navigate these ebbs and flows. These relationships are highly complex, and this is not an economics lecture, so we will try to keep the article focused on what it means for you as a retail trader.

The US national debt hit $34 trillion in 2024 and influences everything from interest rates to currency strength.

A high debt-to-GDP ratio, currently around 120% for the US, signals economic strain and affects investor confidence.

Rising national debt can lead to higher interest rates, which increases borrowing costs and reduces corporate earnings.

Bond yields and ETF values often move inversely to interest rates, making long-duration assets especially sensitive to debt-driven rate hikes.

In FOREX, a weaker US dollar can emerge when debt levels rise and investor confidence drops, but rate differentials can still drive dollar demand.

Commodities like gold benefit from inflation fears tied to national debt, while commodity-linked currencies can gain or suffer depending on dollar strength.

Cryptocurrencies may gain as alternatives in times of fiscal instability, but growing debt could also trigger tighter regulation.

Retail traders should diversify, manage risk with tools like stop-losses, and monitor indicators like interest rates and inflation to adapt to shifting debt-related trends.

Understanding National Debt

The national debt conversation is complex. Understanding any country’s national debt, not least that of the United States, involves grasping its core components: public debt and intragovernmental holdings.

Public debt

This consists of the borrowings by the government sold to individuals, institutions, and foreign governments through instruments like

Treasury bonds

Bills, and

Notes

These are the most visible forms of national debt, directly influenced by market forces and investor sentiment.

Intragovernmental holdings

These represent the money the federal government owes to itself, primarily through trust funds like Social Security and Medicare. These funds are essentially IOUs held by various government agencies, reflecting internal transfers rather than external borrowing. Together, these components form the total national debt, which is a crucial indicator of the country's fiscal health and borrowing habits.

Understanding Debt-to-GDP Ratio

Another important facet is the debt-to-GDP ratio, which measures national debt relative to a country's gross domestic product. For the US, this is approximately 120%, revealing a significant debt burden compared to the nation's economic output. For context, selected advanced nations have debt-to-GDP ratios as follows: Germany 66%, UK 104%, Canada 106%. Some advanced economies, such as Japan, have high debt-to-GDP ratios of 255%.

We learn from this that debt is an inescapable part of running an economy, and different countries have different approaches to it. However, it is commonly agreed that the ratio is a critical metric for assessing economic health. It shows the size of the task a country has in order to service its debt through economic growth. A higher ratio suggests potential challenges in managing debt levels without imposing additional strain on the economy, while a lower ratio typically indicates a more manageable debt situation.

How Does National Debt Affect the Economy?

High levels of national debt can significantly influence the economy in different ways:

Interest rates

As governments borrow more to finance their debt, they compete with the private sector for available capital, which can lead to higher interest rates. Simply because there is more demand for money, leading to constrained supply, rates push up. This phenomenon is known as the "crowding out" effect.

Higher interest rates make borrowing more expensive for consumers and businesses, reducing spending and investment. This can slow economic growth and increase the cost of servicing existing debt. We've written a primer on how interest rates affect your retail holdings.Furthermore, suppose investors believe that a government's debt levels are unsustainable. In that case, they may demand higher yields on government bonds to compensate for the increased risk of default or inflation, pushing interest rates up even further. Central banks may also raise rates to combat inflationary pressures linked to high debt levels, further elevating economic borrowing costs.

Inflation

The relationship among national debt, government spending, and inflation is complex and multifaceted. When the government runs large budget deficits and accumulates debt, it often increases spending or cuts taxes to stimulate the economy. While this can boost economic activity in the short term, excessive spending can lead to inflation if it overheats the economy.

High debt levels may prompt the government to print more money, increasing the money supply and reducing the currency's purchasing power, thereby increasing prices. Additionally, if investors lose confidence in the government's ability to manage its debt, they may sell off government bonds, leading to a depreciation of the currency and further inflationary pressures.

The weakened currency can also make imports more expensive, adding to inflation. Therefore, high national debt can create a cycle of rising inflation, which complicates economic management and erodes the value of savings and fixed-income investments.

Currency strength

The level of national debt also affects the strength of a country’s currency. In the case of the US, when debt levels are manageable and backed by robust economic growth, investors are more likely to view the US dollar as a safe haven, maintaining or even increasing its value. If you've ever found yourself wondering why the US dollar is so enduringly strong, read our article here.

On the other hand, if debt levels become excessively high, confidence in the US dollar may wane. Investors might seek safer assets or currencies, leading to a dollar depreciation. A weaker dollar can have broad implications, such as making US exports more competitive abroad but increasing the cost of imports, which can contribute to inflation.

Thus, national debt levels can directly impact the currency's value and its role in the international financial system, influencing trade balances, investment flows, and the overall economic landscape. The US dollar has predominantly been a safe-haven asset, owing to the generally strong performance of the US economy.

The Role of Credit Ratings in National Debt Management

Credit ratings play a crucial role in managing national debt, influencing everything from borrowing costs to investor confidence. A country’s credit rating, issued by agencies like Moody’s, S&P, and Fitch, reflects its ability to repay its debt. High ratings, like the much-desired AAA+ rating, indicate low risk, allowing a country to borrow at lower interest rates, while downgrades can lead to higher borrowing costs. For the U.S., maintaining a high credit rating is essential given its substantial debt levels. A downgrade, triggered by rising debt and fiscal instability, can increase the cost of borrowing, and this effect can find its way into household budgets.

The impact of credit ratings extends beyond just borrowing costs. These ratings also affect investor sentiment and market stability. When a country’s credit rating is downgraded, it can lead to a sell-off in bonds and other assets, causing market volatility. Investors may demand higher yields to compensate for perceived risks, which can tighten financial conditions and slow economic growth. In extreme cases, significant downgrades can undermine confidence in a country’s financial system, leading to capital flight and currency depreciation, with widespread repercussions across global markets. As we have seen with countries like Argentina, Venezuela, and Turkey, ratings downgrades have real effects.

For retail investors like you, understanding national credit ratings gives you insights into the economic health of a country and help investors assess the risks associated with government bonds and other debt-related investments. Staying informed about potential rating changes and their triggers, such as rising debt levels or political instability, can help you make more informed decisions and adjust your portfolios accordingly to mitigate risks associated with national debt management.

Impact on Your Investments

So, what does all of this mean for the average investor? As we have said, these complex financial concepts span broad macroeconomics to individual financial portfolios. We don’t have room to expand on every possible link, so we will paint broad brush strokes for you.

Stocks

If investors are concerned about high national debt levels, this can seriously affect their confidence in a particular market. This can in turn influence stock market volatility. When investor confidence plummets, sell-offs in the stock market can happen as investors look for safe havens.

What you get from this market volatility is a self-reinforcing cycle of declining stock prices and increased market fluctuations, and the pursuant trading opportunities you can keep track of through stock signals. Further, high debt levels can raise concerns about future tax increases or spending cuts that could slow economic growth and negatively impact corporate earnings, further dampening investor sentiment and contributing to a weak market outlook.

As we have shown, higher interest rates, often a consequence of elevated national debt, can significantly affect corporate borrowing costs, which in turn can impact corporate profits and stock prices. If a company is facing a higher cost of capital for new projects, expansions, or acquisitions, then it will be less able to grow. Higher interest expenses can erode profit margins and reduce net earnings.

Winners:

In a high national debt and high interest rate environment, sectors like finance, which benefit from higher interest rates through improved lending margins, may experience a more favorable impact.

Losers:

High national debt and its associated challenges can lead to lower stock prices as investors adjust their expectations for future profitability. Sectors that rely heavily on borrowing, such as real estate, consumer goods, and capital-intensive industries, are particularly vulnerable to rising interest rates, which can lead to a decline in their stock valuations.

Bond markets

National debt significantly influences yield curve dynamics. Let’s tell you how:

When national debt levels are high, the government typically issues more long-term bonds to finance its debt. Remember, it wants more money to pay for the cost of servicing this debt. However, this increases the supply of bonds in the market, which can lead to higher long-term interest rates if those bonds are not purchased.

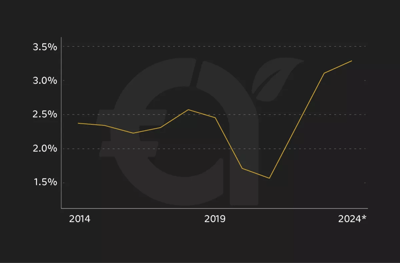

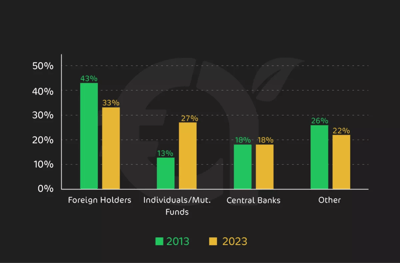

In times of economic uncertainty, investors always seek the relative safety of long-term government bonds. This demand for bonds drives down yields, meaning a government must sell even more bonds to cover its debts. This cycle can lead to a flattening or even an inversion of the yield curve. One result is that foreign holders could find US Treasury debt less attractive, as shown by the following graph.

An inverted yield curve can signal anticipated economic slowdowns, prompting investors to reassess their portfolios to mitigate risks associated with changing interest rates. It’s a complicated relationship of supply and demand. It requires bond investors to know the dynamics at play and anticipate when the tide will turn in their favor.

Winners:

High national debt levels come with perceived increased credit risk, compelling investors to demand higher yields on US bonds to compensate for the potential risk of default or inflation eroding the value of their returns. Bond buyers benefit from being market makers in this instance.

Losers:

Bonds are highly sensitive to changes in interest rates, which are often influenced by national debt levels. As the government borrows more and interest rates rise, existing bonds with lower coupon rates become less attractive, leading to a decline in their market value.

ETFs

You should know that bonds and ETFs are closely linked. A bond ETF operates as a basket of bonds by pooling a variety of individual bonds into one investment vehicle, providing diversification, ease of trading, and access to a broad range of fixed-income securities.

These securities are highly sensitive to national debt and changing interest rates. As interest rates increase, the yield on newly issued bonds becomes more attractive compared to the lower yields of existing bonds held by bond ETFs.

This discrepancy decreases the market value of older bonds, resulting in a drop in their net asset value. Therefore, the longer the duration of the bonds within the ETF, the more sensitive it is to interest rate changes, making long-duration bond ETFs particularly vulnerable during periods of rising rates driven by national debt concerns.

Winners:

Currency-hedged ETFs are a critical area influenced by fluctuations in the US dollar, particularly for ETFs with significant international exposure. When the US national debt levels lead to concerns about the dollar’s value, currency fluctuations can impact the returns of these ETFs. A weakening dollar can boost the performance of currency-hedged ETFs by increasing the value of foreign investments when converted back into dollars, providing a hedge against currency risk.

Additionally, infrastructure-focused ETFs might gain if the government invests heavily in public works to boost economic growth and manage debt.

Losers:

ETFs focused on such capital-intensive private sectors as utilities and real estate, which often rely on borrowing, may experience negative impacts from higher interest rates associated with elevated national debt.

FOREX

A high level of debt might signal to investors that the government will either need to raise taxes, cut spending, or both, which can slow economic growth. This shift can lead to a weaker dollar, impacting international trade balances, as US goods and services become cheaper abroad but imports become more expensive for American consumers.

When the US national debt rises significantly, it may raise concerns about its fiscal health and ability to repay debt, prompting a dollar sell-off in favor of currencies from countries with more stable fiscal policies. Such concerns can weaken investor confidence in the US dollar, leading to depreciation against other currencies in the FOREX market.

Winners:

Interest rate differentials play a crucial role in FOREX trading strategies. Higher US interest rates than those in other countries can attract foreign investment in dollar-denominated assets, driving up demand for the US dollar and leading to its appreciation.

Losers:

Conversely, if debt concerns lead to expectations of future economic instability or higher inflation, the Fed might adopt a more accommodative stance to support growth, potentially lowering interest rates. This could decrease the interest rate differential between the US and other countries, reducing the attractiveness of dollar investments and leading to currency depreciation.

FOREX traders often exploit these interest rate differentials, borrowing in currencies with lower interest rates and investing in currencies with higher rates to profit from the differential.

This dynamic shows the complex relationship between national debt and currency stability, highlighting the need for you to carefully monitor debt levels and broader economic indicators to anticipate shifts in currency preferences and adjust their FOREX trading strategies accordingly.

Commodities

High national debt and inflationary pressures can drive up prices for commodities such as gold and oil. Inflation erodes the purchasing power of currency, making commodities priced in that currency relatively more expensive.

Winners:

For example, gold is often seen as a hedge against inflation because it retains intrinsic value, unlike currency which can depreciate. As inflation expectations rise due to high national debt, investors flock to commodities like gold, increasing prices.

Similarly, oil prices can increase as inflation raises the cost of production and transport. Additionally, commodities can become more appealing as tangible assets likely to maintain value when currency-based investments lose purchasing power due to inflation.

Shifts in US debt levels can significantly affect commodity-linked currencies, which are the currencies of countries that are major exporters of commodities like oil, gold, and minerals. When the US national debt rises and the dollar weakens, the relative value of commodities often increases, benefitting countries like Canada, Australia, and Russia, which rely heavily on commodity exports. A weaker US dollar can make these countries' exports cheaper and more competitive globally, potentially boosting their economies and strengthening their currencies.

Losers:

Conversely, suppose high US debt leads to higher interest rates and a stronger dollar. In that case, commodity prices may fall in dollar terms, potentially harming the economies and currencies of commodity-exporting countries such as oil-producing nations like Saudi Arabia and China. From this we can see how changes in US debt levels can ripple through global markets, impacting exchange rates and economic conditions in commodity-dependent economies

Cryptocurrencies

Concerns about traditional financial systems and rising national debt can significantly boost interest in cryptocurrencies as alternative investments. As national debt levels escalate, confidence in conventional financial structures can reduce, leading investors to seek alternatives that are perceived as more secure or less vulnerable to government mismanagement and economic instability.

In truth, this remains the ideal scenario for cryptocurrencies. Still, it is debatable whether they are trusted enough to be seen as a store of value in times of high national debt and high inflation.

Winners:

Cryptocurrencies should offer an appealing alternative with their decentralized nature and independence from central bank policies. They are not subject to the same inflationary pressures that can arise from government debt accumulation, which makes them attractive to investors looking to diversify their portfolios away from traditional assets like stocks and bonds.

Losers:

However, the rising interest in cryptocurrencies due to national debt concerns also brings increased regulatory scrutiny. As governments grapple with high debt levels, they may look to tighten regulations on alternative financial systems, including cryptocurrencies, to maintain economic stability and control capital flows. Increased regulatory oversight could come from stricter compliance requirements, higher taxes on crypto transactions, or even bans on certain activities like initial coin offerings (ICO).

For instance, if a government perceives that the popularity of cryptocurrencies is undermining its monetary policy or contributing to capital flight, it may implement more rigorous regulations to curb these effects.

Strategies for Retail Traders

So, what are some of the best ways to respond to the changing of the national debt of the United States? As you will see, the answers are not new or radical.

Diversification

Diversification will always be a critical strategy for retail traders, especially in the context of high national debt and its associated risks. By spreading investments across various asset classes, such as stocks, bonds, commodities, and cryptocurrencies, you can reduce your exposure to the potential negative impacts of any single market.

For instance, while equities might suffer from rising interest rates and economic uncertainty linked to high debt levels, commodities like gold could benefit from their status as inflation hedges. Similarly, allocating a portion of investments to foreign assets can protect against currency depreciation, which often accompanies national debt concerns.

Diversification helps balance the portfolio and capture opportunities across different markets that may react differently to economic changes. By not putting all your eggs in one basket, you can mitigate losses and enhance your ability to weather financial turbulence caused by high national debt.

Risk management

Effective risk management is crucial in a high-debt environment with volatile and unpredictable economic conditions. You should implement risk-management techniques such as setting stop-loss orders to automatically sell assets if their prices drop to a certain level, thereby limiting potential losses.

Maintaining liquidity is also vital; having sufficient cash or liquid assets ensures that traders can meet margin calls and take advantage of market opportunities without selling assets at a loss. You should also be cautious with leverage, as high debt levels can lead to rapid changes in interest rates and market conditions, amplifying gains and losses.

Monitoring economic indicators

Staying informed about key economic indicators is essential, particularly in an environment influenced by high national debt. Monitoring interest rates, inflation data, and debt-to-GDP ratios provides valuable insights into the economy's health and the potential direction of market trends.

Changes in these indicators can signal shifts in economic policy and investor sentiment that can significantly impact asset prices. For example, rising interest rates may suggest a tightening monetary policy to combat inflation, which could negatively affect bond prices and equity markets.

On the other hand, increasing debt levels and inflation might drive demand for commodities like gold. By monitoring these indicators closely, you can make informed decisions and adjust your strategies to align with the evolving economic landscape.

Adapting to market conditions

In times of economic instability, you should consider focusing on more stable, defensive sectors such as utilities and consumer staples that are less sensitive to economic cycles. Conversely, more aggressive investment in growth sectors like technology might be appropriate if debt levels stabilize or decrease.

You should also remain flexible in your approach, ready to shift from high-risk to low-risk assets depending on market signals. For example, if economic indicators suggest a downturn, you might move from equities to bonds or commodities. This should all be part of your trading plan.

As always, incorporating technical analysis and staying updated on geopolitical events can give you further insights into market conditions, help you adjust your strategies to manage risks effectively, and capitalize on new opportunities as they arise

Conclusion

Understanding the US national debt and its far-reaching implications is important in investing. National debt levels affect everything from interest rates to the strength of the US dollar, influencing market stability and economic growth. High debt levels can drive up interest rates, leading to more expensive borrowing costs, and can contribute to inflation, reducing the purchasing power of your money. As we have shown, the impact on various investment classes is profound: from stock volatility and shifting yield curves in bond markets to the fluctuating values of ETFs, FOREX, and even commodities. Navigating these challenges requires a strategic approach, including diversifying your portfolio, managing risks, and staying informed about key economic indicators.

FAQ

High levels of national debt can lead to higher interest rates as the government competes with the private sector for available capital, driving up the cost of borrowing. This phenomenon makes loans more expensive for consumers and businesses, potentially slowing economic growth.

The national debt impacts the stock market by influencing investor confidence and interest rates. Concerns about high debt levels can lead to market volatility and sell-offs, while higher interest rates increase corporate borrowing costs, potentially reducing profits and dampening investor sentiment.

National debt levels can affect the strength of a country's currency, such as the US dollar. Manageable debt backed by economic growth maintains confidence in the currency, whereas excessive debt can lead to depreciation, affecting international trade balances and investment flows.

High national debt typically leads to the issuance of more long-term government bonds, increasing supply and potentially driving up long-term interest rates. This can result in a flattening or inversion of the yield curve, which signals economic uncertainty and prompts investors to reassess their portfolios.

Effective strategies include diversification across various asset classes, maintaining liquidity, and closely monitoring economic indicators like interest rates and inflation. Adapting to market conditions by shifting investments in response to economic signals can also help manage risks associated with high national debt.

National debt can drive inflation by increasing government spending or cutting taxes, stimulating economic activity. If this leads to an overheated economy, prices can rise. High debt levels may also prompt the government to print more money, increasing the money supply and reducing the currency's purchasing power, further fueling inflation.

National debt affects bond ETFs by influencing interest rates. As rates rise due to higher debt levels, newly issued bonds become more attractive than those in existing ETFs, decreasing their market value. Bond ETFs with longer durations are particularly sensitive to these changes, making them more vulnerable during periods of rising rates driven by national debt concerns.