Oil Price Consolidates Despite Lingering Omicron Fears

Oil prices rallied on Wednesday as investors monitored the rising number of cases of the Omicron COVID-19 variant. Although there is mounting evidence that Omicron produces milder symptoms, it is still highly transmissible. Spiraling case numbers in several countries have put investors on edge.

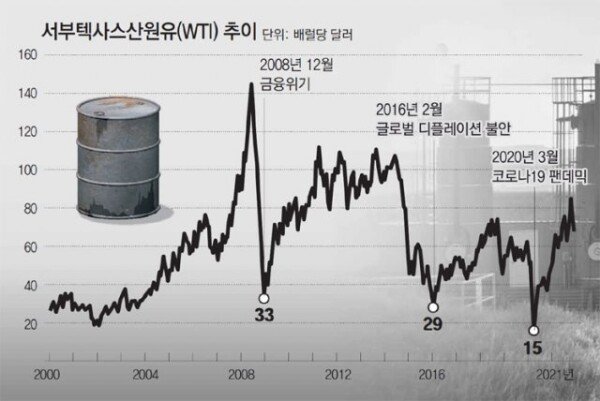

Brent crude futures slid by 0.03%, to $80.04 a barrel while US West Texas Intermediate crude futures rose 0.03%, to $77.01 a barrel.

The US reported close to one million new Coronavirus infections on Monday, a new all-time record. At the same time, several European countries are dealing with skyrocketing case numbers. Finally, in Australia, tension is mounting at the prospect of new lockdowns.

Meanwhile, OPEC exporting countries, along with Russia, have agreed to add another 400,000 daily barrels of supply in continued attempts to boost global oil stocks. The call to honor this output increase reflects OPEC’s view that Omicron will have a manageable impact on global energy demand.

What does this mean for me?

Oil is a vital commodity for the global economy. Major nations, led by the US, have been trying to boost the supply of oil to bring the global price down. The objective of this is to cool oil prices, which will have the direct effect of reducing consumer prices.

For the commodities trader, the ongoing storyline in the short term will be the continued attempts by OPEC partners to keep energy prices down. The ongoing pandemic will have periodic impacts on the oil price, which is worth keeping with view.

More News

Copper Prices Head Into Uncharted Territory

Silver’s Surge Shows Rate-Cut Bets and a New Layer of Trade Risk

.webp)

Gold’s Breakout Year Sets a High Bar for 2026

.webp)

Europe’s Gas Chill Turns Into a Price Rout

The Rare Earths Boom Driving a New Global Supercycle

.webp)

Brent Rises as Fresh U.S. Sanctions Choke Russian Oil Exports

Global Wind Market Set to Hit $304 Billion by 2029

.webp)