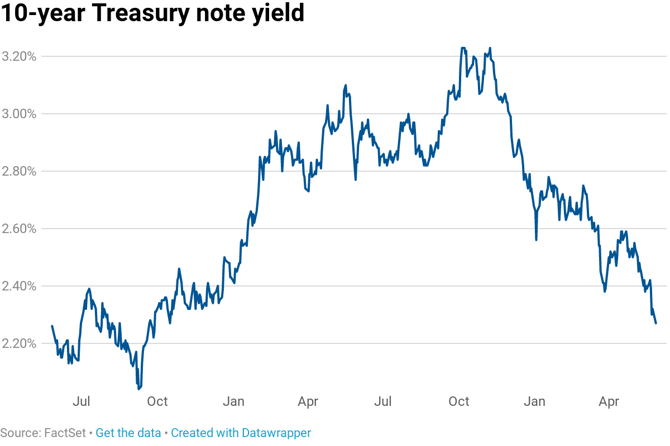

10-year Treasury Yield Surges to 11-year High

The 10-year US treasury bond yield surged to its highest level in 11 years, as investors mulled the likelihood of the US Federal Reserve taking even more aggressive steps to tame inflation.

The yield on the all-important 10-year treasury note climbed to 3.483%, a level not witnessed since early 2011. The two-year yield was also affected, leaping some 16 basis points to 3.437%, a 15-year high.

Analysts believe the Fed is still far behind where it needs to be with interest rates. The market is already pegging financial instruments at a higher level than that which the Fed’s adjustments can keep up. Still, investors are bracing themselves for a 75-basis-point hike from the Fed this week, rather than a 50-basis-point hike indicated earlier in the year.

The most recent inflation report showed prices are still red hot. Indeed, new inflation data released on Tuesday indicated that wholesale prices rose 10.8% in May, close to record margins.

What does this mean for me?

Continued high inflation readings are causing investors to dump lower-priced bonds purchased earlier in the year and hedging their bets that higher bond yields are in the pipeline.

Bond markets are witnessing an intense sell-off as market watchers await the start of the Fed’s two-day policy meeting. For the bond investor, it is easy to follow the rationale of the market. Why hold onto lower yielding bonds when there is every chance of improved yields hitting the market soon?

More News

Wall Street Rallies as the S&P 500 Pushes Deeper Into Record Territory

Novo Nordisk Shares Soar as FDA Clears First Weight-Loss Pill

From Comeback to Contender: Can Europe’s Banks Deliver Again in 2026?

Oracle’s Miss Stirs Fresh AI Bubble Jitters

Netflix’s $72bn Power Play Sets Up a Streaming Shockwave

HP Bets on AI as Cost Pressures Mount and Layoffs Deepen

SoftBank Cashes Out of Nvidia to Double Down on AI Bets