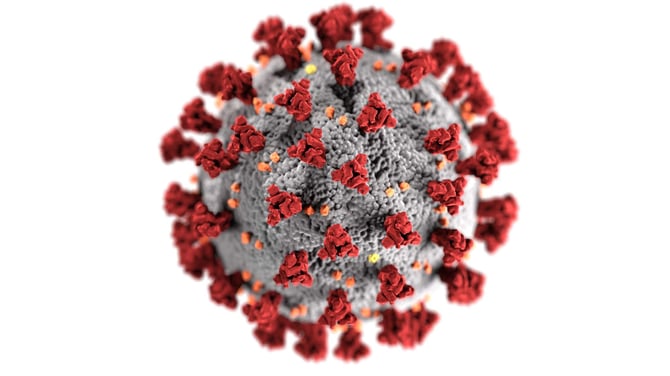

New Covid-19 Variant Spooks Markets

Global stocks fell on Friday on the back of fears that a new infectious strain of COVID-19 could cause renewed restrictions.

The Dow faced its worst trading day in a year, with global oil prices also taking a hit. The emergence of a new COVID-19 variant in a handful of countries, including South Africa, Israel and Hong Kong, has already resulted in flight bans in selected countries.

The Dow fell 2.5%, its worst performance since October 2020. Meanwhile, the S&P 500 tumbled 2.3%, a fall not seen since February 2021. The Nasdaq completed the rout, finishing the day 2.2% lower.

Oil prices joined the decline, with US oil futures slipping roughly 12%. Brent crude dropped more than 10% to $73.66 per barrel. However, the lower oil price was not unwelcome news, after the recent sell-off of oil reserves by the US and other countries was intended to do just that.

What does this mean for me?

It is a confusing time for markets. Improved Black Friday trading was meant to help stocks close stronger on Friday, but the big consumer sales day could not deflect from COVID-19 fears.

As a trader, you should know that with so much recent volatility, many investors are looking at getting into safe-haven investments. The 10-year US Treasury bond became slightly more expensive after a swell of interest in recent weeks. Yields fell slightly by 0.1 percentage points, driven by higher demand.

More News

.webp)

US Dollar Faces Biggest 6-Month Drop in Half a Century

.webp)

Dollar Slips to Three-Year Low as Trump Eyes Early Fed Appointment

.webp)

AI-Powered Trading Bots Bring a New Kind of Threat

.WEBP)

Euro Value Surges as Markets React to Tariff Shock

Euro’s Slide: What’s Behind the Drop and What’s Next?

Sterling Gains Against Euro as Central Banks Move Apart

Euro Remains Steady Amid Tariff Threats