High Inflation Drags Consumer Sentiment to Record Lows

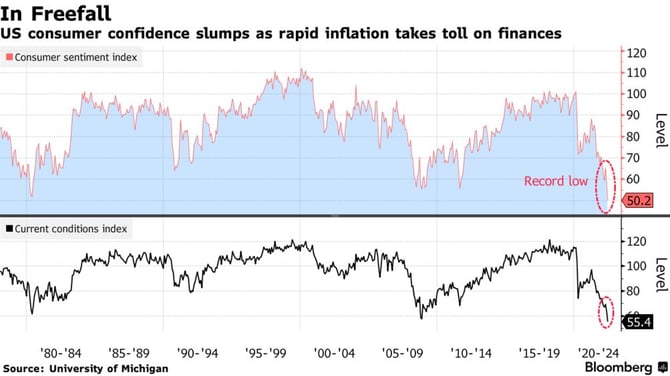

Consumer sentiment reached record lows in June as Americans continued to grapple with high prices for such everyday essentials as gas and food.

The University of Michigan's Surveys of Consumers Consumer Sentiment Index reached its lowest level on record. The series was launched in the mid-1970s.

Inflation, which increased at the fastest pace in four decades, is the primary reason for the erosion in sentiment. According to the survey, four out of every five consumers expected tough times in the year ahead for businesses and consumers alike.

Inflation was the biggest concern for consumers. Some 47% of respondents polled blamed inflation for cratering their living standards.

Consumer sentiment is the latest indicator to slide after rapid deterioration in key parts of the US economy. Influential studies have shown the country’s purchasing managers' index and manufacturing output index have both taken a pounding all year.

What does this mean for me?

Analysts point out that confidence has slumped to a level that normally heralds a sharp economic downturn. Some commentators are saying that weak consumer confidence is a generalized concern around the world.

As a diversified investor, you doubtless have been keeping an eye on the steady slide into dangerous waters for the global economy. The days of pandemic-era monetary stimulus have given way to high inflation, monetary tightening, and the real risk of a global recession.

More News

.webp)

US Dollar Faces Biggest 6-Month Drop in Half a Century

.webp)

Dollar Slips to Three-Year Low as Trump Eyes Early Fed Appointment

.webp)

AI-Powered Trading Bots Bring a New Kind of Threat

.WEBP)

Euro Value Surges as Markets React to Tariff Shock

Euro’s Slide: What’s Behind the Drop and What’s Next?

Sterling Gains Against Euro as Central Banks Move Apart

Euro Remains Steady Amid Tariff Threats