Continued Fed Rate Hikes Affecting Bond Markets

An increasing number of analysts are predicting that persistently high inflation will force the Federal Reserve to resort to the biggest increase in a key US interest rate in more than 40 years.

At the last two meetings, the US Fed raised the targeted rate by 0.75 of a point. Some economists predict a full percentage point increase will follow. The last such drastic move came in the early 1980s.

High inflation has put Federal Reserve chief Jerome Powell in a tight spot. He could trigger a recession in his effort to tame inflation, but many argue has no choice in the matter. In the meantime, markets must try to adjust to the shifting ground.

What does this mean for me?

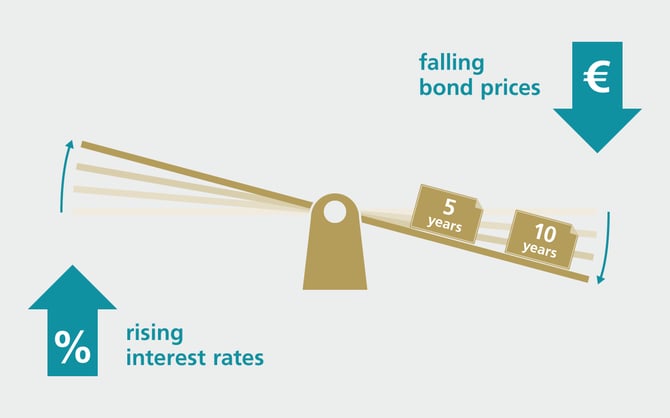

One area that interest rate hikes are affecting is bond yields. Interest rates tend to follow long-term growth and inflation trends, with high inflation often leading to higher interest rates.

The benchmark 10-year US treasury note yielded 1.5% at the end of 2021, but now sits at about 3.4%. Investors consider this a negative development because of the inverse relationship between bond yields and bond prices.

When yields rise, prices of bonds already in the market fall. This is a function of supply and demand. When demand for bonds declines, issuers of new bonds must offer higher yields to attract buyers, reducing the value of lower-yielding bonds already on the market. This situation is playing out at present and is hitting bondholders hard.

More News

.webp)

Canada Shields Steel and Lumber Industries From Tariffs

7 hours ago

Trump Drops Selected Tariffs in Response to Inflation Pressures

2 days ago

Tariffs on Mexico Test Nuevo Leon’s Industrial Momentum

6 days ago

US Moves to Ease Latin American Tariffs as Food Inflation Mounts

1 week ago

Japan Faces First GDP Shrinkage in Six Quarters as Tariffs Bite

1 week ago

India’s Inflation Dip Strengthens Case for RBI Easing

2 weeks ago

Europe Rallies as Shutdown Eases, Earnings Impress

2 weeks ago

Germany’s Trade Surplus Slides as Imports Outpace Exports

2 weeks ago