US Bond Yields Spike as Markets Eye a Recession

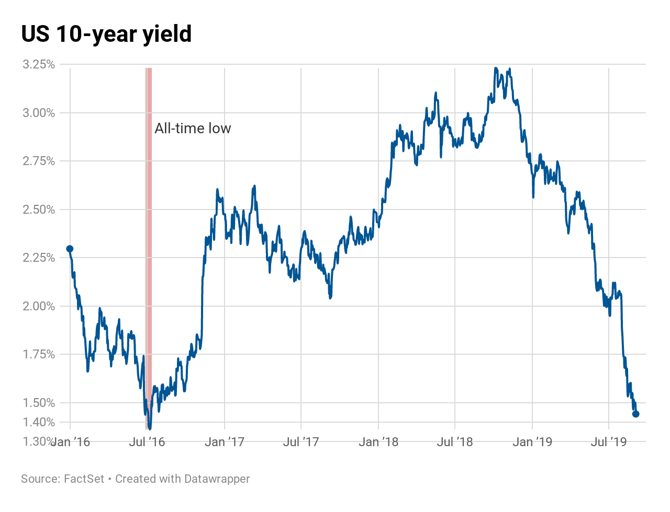

US bond yields leapt this week after another significant rate hike from the Federal Reserve. The two-year treasury yield climbed to 4.3%, a 15-year high, and the 10-year treasury breached 3.9%, a level not seen in 11 years.

The two-year treasury yield is more sensitive to short-term policy moves, making its 15-year high more significant. Responding to hawkish interest rate hikes in the face of a possible recession, the stock markets wobbled, with the Dow Jones Industrial Average dropping nearly 600 points into bear market territory, a new low for 2022.

Interest rates and bond prices normally travel in opposite directions, which means soaring interest rates should cause bond values to tumble, as is happening now. There is also an inverse relationship between bond prices and yields, with yields naturally rising as bond values drop.

The most worrying element of these latest developments is that yield curve inversions, occurring when shorter-term government bonds have higher yields than long-term bonds, are usually an indicator of a possible future recession.

What does this mean for me?

Higher bond yields in general are not always good news for the stock market and investors as they create more competition for investor money that may otherwise go into the stock market. Further, it may be less attractive for companies to issue bonds for stock buybacks, which is a method for profitable firms to return cash to shareholders.

More News

.webp)

Japan’s Rate Shift Is Rippling Through Global Bond Markets

1 week ago

China’s Growth Engine Stalls as Consumers and Investors Pull Back

1 week ago

Egypt’s Recovery Gains Traction as Household Pressure Lingers

2 weeks ago

OECD Warns AI and Tariffs Will Test the Global Economy

3 weeks ago

Zero Tariffs, Higher Drug Bills as US and UK Reset Pharma Trade

3 weeks ago

Catastrophe Bonds Go Global as Climate Risk Meets Yield Hunting

4 weeks ago

.webp)

Canada Shields Steel and Lumber Industries From Tariffs

1 month ago

Trump Drops Selected Tariffs in Response to Inflation Pressures

1 month ago