Top Stablecoin Loses Dollar Peg

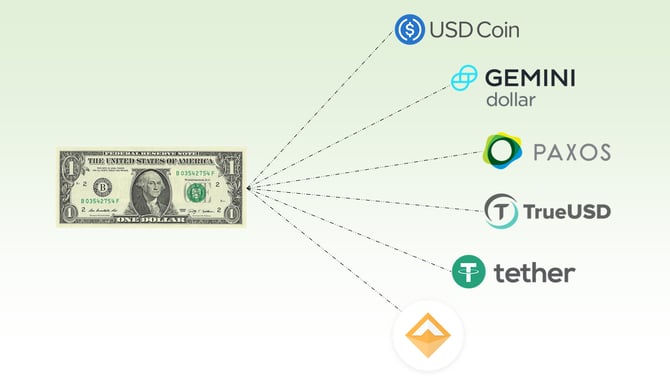

Tether, the world’s biggest stablecoin that pegs its value one-to-one with the US dollar, is losing value and can no longer maintain its equal pegging.

Stablecoins are usually a place of safety for crypto investors during times of turbulence. With Bitcoin suffering heavy losses in recent times, seeing a stablecoin like Tether struggle is doubly concerning.

Tether briefly dropped to its lowest level since December 2020, falling to 94.55 cents on Thursday before recovering to just above 99 cents.

The stablecoin is a crucial cog to the many crypto trades being actioned across the market at any given time. Investors put their money in stablecoins as a safe haven during times of volatility.

Tether’s dip coincided with a massive selloff in cryptocurrencies that wiped more than $200 billion in value from the market in 24 hours.

The market panic from Tether’s fall caused traders to rush to swap one stablecoin for another. Rival stablecoin USDT was the main benefactor, seeing its trading numbers skyrocket.

More than $1.8 billion of Tether was removed from the market between Wednesday and Thursday this week, as the stablecoin’s market value dropped to as low as $82.2 billion from $84.2 billion.

What does this mean for me?

Analysts feel that Tether’s de-pegging is being driven by market sentiment rather than real concern over its reserves or its strength.

For the cryptocurrency trader, periods of volatility such as this can be unnerving, as they show how vulnerable the market is to panic and negative sentiment. However, it is all part of an immature market’s journey to widespread acceptance.

More News

Crypto Turmoil Finds New Drivers as Bitcoin Struggles to Rebound

.WEBP)

Bitcoin Stable After Sharp Selloff Erases 2025 Gains

Bitcoin Rallies as US Shutdown Sends Traders to Safe Havens

Washington Fuels Record-Breaking Crypto Rally

Bitcoin Rockets Past $115K as Traders Pounce on the Dip

US Moves to Regulate Stablecoins in Major Crypto Breakthrough

Bitcoin Surges Past $120,000 as ETFs Drive Momentum