Western Companies Ditch Russia

Russia pushed through a hasty presidential decree designed to stop a wave of capital outflows from Western companies selling up in the country.

Foreign companies are leaving in droves. Some are trying to physically disinvest from Russia while others have put the brakes on supplying their services.

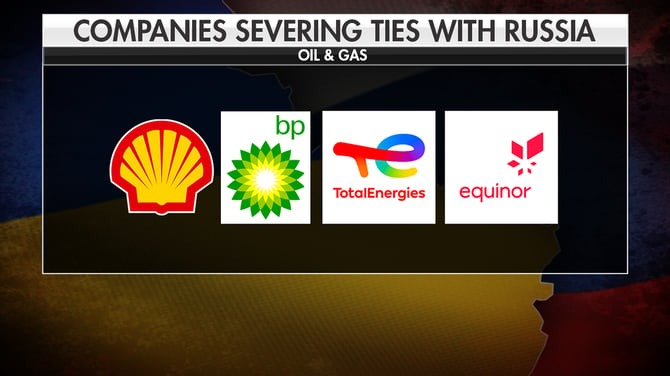

Oil giant BP announced it was planning to exit its 19.75% stake in Russia's biggest oil company, Rosneft. Shell and Norway's Equinor followed suit.

Exxon Mobil pledged not to invest in new developments in the country, mirroring the stance of France's Total Energies. Google, Apple and Ford all curtailed services in some measure.

Visa and Mastercard are working to enforce sanctions against Russia, ratcheting up the financial pressure. Norway's $1.3 trillion sovereign wealth fund will divest shares in 47 Russian companies, as well as government bonds.

Russian Prime Minister Mikhail Mishustin said the companies were responding to “political pressure,” and would be stopped from selling Russian assets until that pressure subsides.

What does this mean for me?

Russia is in a vice grip of government-level sanctions, which are now being supplemented by the actions of individual companies.

Russia’s economy is in turmoil as the effect of these sweeping sanctions takes hold, with the worst expected to come when ordinary citizens cannot access cash, services and food.

As a diversified trader, expect any assets in your portfolio connected to Russia to continue to face an uncertain short- to medium-term future.

More News

India Moves to Control Inflation Through Rate Hikes

China Lockdowns Start to Affect Production

Tesla’s Berlin Factory Begins Production

List of Companies Leaving Russia Keeps Growing

Russian Oligarchs and Ordinary Citizens Feeling the Pinch of Sanctions

Russia Feels the Bite of Sanctions

Ukraine Crisis Escalates with Closure of Gas Pipeline, Sanctions