Japan’s Nikkei Hits 33-Year High

Asia-Pacific markets mostly rose this week, rebounding from a sell-off in the previous session, with the Nikkei 225 hitting a 33-year high on the back of gains in tech stocks. The index scaled an intraday peak of 33,969.17, its highest level since March 1990.

Top gainers on the Nikkei were chip-related stocks, that tracked gains in U.S. peers Nvidia and Advanced Micro Devices. Semiconductor company Tokyo Electron and chip equipment supplier Advantest climbed as much as 4.87% and 8.36%, respectively.

Video-game company Nintendo was also among the top performers, gaining as much as 4.7%, as news circulated that the company might release a new game console this year.

Investors also considered December inflation numbers for Japan’s capital city of Tokyo, which are a leading indicator for nationwide inflation.

Tokyo’s inflation rate slowed to 2.4% in December from 2.6% in the previous month. Core inflation — which strips out prices of fresh food — remained unchanged at 2.1%, and came in line with expectations.

What does this mean for me?

Elsewhere in the region, Australia’s retail sales for November 2023 also rose more than expected, gaining 2% month-on-month and beating economists’expectations of 1.2%. The country’s benchmark S&P/ASX 200 index climbed 0.93%.

South Korea’s Kospi slipped 0.26% to 2,561.24, the only benchmark index in negative territory as Samsung Electronics cut its earnings forecast for the fourth quarter of 2023.

Hong Kong’s Hang Seng index inched up 0.34%, while the mainland Chinese CSI 300 was up 0.29%.

More News

Germany’s Fragile Consumer Sentiment Weighs on Markets

2 days ago

The Dow Jones is in a Historic Funk

3 days ago

Eurozone Growth Hits Two-Year Peak Despite Trade Challenges

1 week ago

India's Economic Growth Stutters Amid Global Uncertainty

3 weeks ago

Oil Watchers Warn Proposed Tariffs Could Upend Global Trade

3 weeks ago

Singapore’s Inflation Slows Down as GDP Growth Picks Up

3 weeks ago

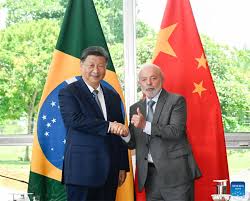

Brazil and China Strengthen Trade Ties Further

1 month ago

UK Inflation Hits 2.3% on Back of High Energy Prices

1 month ago