Japan’s GDP Shrinks as Cost of Living Bites

Japan's economy contracted for the first time in two quarters, as COVID-19 curbs affected the performance of the services sector, and the Ukraine war continued to inflate commodity prices and create headaches for consumers.

The world’s third-largest economy fell at an annualized rate of 1% in the first quarter. Many analysts expect the situation to improve in coming quarters, but the war in Ukraine and a slowdown in the Chinese economy are complicating matters.

Despite easing COVID-19 restrictions, Japan’s recovery may not be straightforward, as rising energy costs and those of food, in addition to a weak yen, could dilute domestic demand.

Japan is highly reliant on exports, but any gains in this area are under pressure from inflated imports, which are being driven by the weak yen and surging global commodity prices.

One ray of light was capital spending, which rose 0.5% against an expected 0.7% increase, following a 0.4% jump in the previous quarter.

What does this mean for me?

The biggest economies in the world are facing pressure from multiple threats, like lingering inflation, coronavirus disruptions, and the war in Ukraine.

As a diversified investor, you will need to keep an eye on these mega trends and begin to understand how they can affect the performance of even the most robust economies.

Even Japan, a well-managed economy that plays to its strengths in areas like technology and exports, is unable to prevent economic shrinkage.

More News

Germany’s Fragile Consumer Sentiment Weighs on Markets

The Dow Jones is in a Historic Funk

Eurozone Growth Hits Two-Year Peak Despite Trade Challenges

India's Economic Growth Stutters Amid Global Uncertainty

Oil Watchers Warn Proposed Tariffs Could Upend Global Trade

Singapore’s Inflation Slows Down as GDP Growth Picks Up

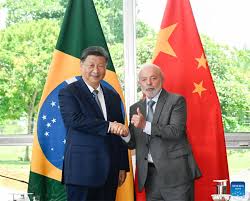

Brazil and China Strengthen Trade Ties Further