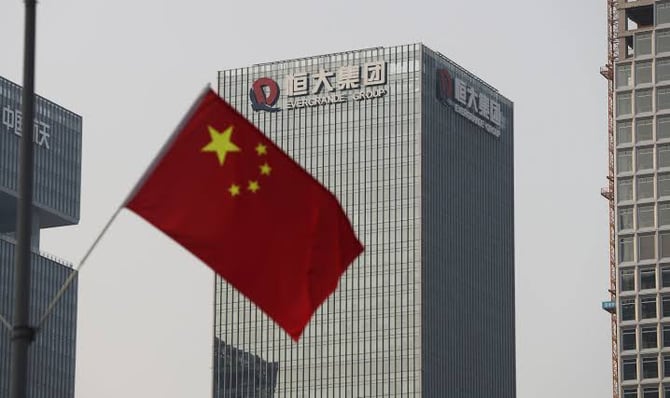

China’s Evergrande Files for Bankruptcy

In a striking blow to China's once-dominant property sector, Evergrande Group, once the nation's second-largest property developer, announced its bankruptcy filing in New York this Thursday.

Having defaulted on its substantial debts in 2021, Evergrande's financial missteps ignited a property downturn in China's economy, with repercussions still being felt. The company has now turned to Chapter 15 bankruptcy protection, a measure designed to facilitate collaboration among US courts, debtors, and foreign jurisdictions during cross-border insolvency proceedings.

Long held as a cornerstone of the world's second-largest economy, China's real estate industry contributed up to 30% of its GDP. But Evergrande's unexpected 2021 default sent tremors through China’s property sector, leaving homeowners in distress and creating instability in the nation's broader financial landscape.

This financial catastrophe unfolded amid Beijing's efforts to curtail exorbitant borrowing by developers, aiming to stabilize skyrocketing housing prices.

What does this mean for me?

Evergrande's 2021 fall was only the beginning. Leading developers like Kasia, Fantasia, and Shimao Group have since joined the ranks of defaulters, casting further doubts over the stability of the Chinese property market. This sectoral meltdown has been exacerbated by the broader economic deceleration in China.

Plagued by its inability to settle its dues post-default, Evergrande's debt soared to a staggering $340 billion by the end of last year, equivalent to roughly 2% of China’s entire GDP. In a further blow to investor confidence, a recent stock market disclosure revealed Evergrande lost $81 billion of shareholder capital over 2021 and 2022.

More News

.webp)

Japan’s Rate Shift Is Rippling Through Global Bond Markets

2 weeks ago

China’s Growth Engine Stalls as Consumers and Investors Pull Back

2 weeks ago

Egypt’s Recovery Gains Traction as Household Pressure Lingers

3 weeks ago

OECD Warns AI and Tariffs Will Test the Global Economy

1 month ago

Zero Tariffs, Higher Drug Bills as US and UK Reset Pharma Trade

1 month ago

Catastrophe Bonds Go Global as Climate Risk Meets Yield Hunting

1 month ago

.webp)

Canada Shields Steel and Lumber Industries From Tariffs

1 month ago

Trump Drops Selected Tariffs in Response to Inflation Pressures

1 month ago