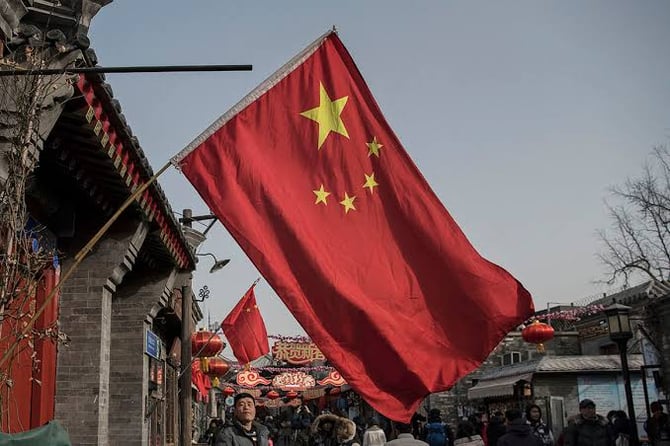

China’s Economic Turmoil Sends Global Alarm Bells Ringing

China's economy has hit a rough patch, signalingpossible global challenges. For nearly 20 years, China's economic surge has boosted the world's economy. So, if China's economic pace slows, the remainder of the world will feel its effects.

According to the country's National Bureau of Statistics, Chinese consumer spending, factory production and investment in long-term assets (such as property, machinery or other goods) all slowed further in July from a year ago.

The youth jobless rate in China, the world's second-biggest economy, keeps breaking records. In a surprising move, Beijing stopped sharing this monthly unemployment data.

Meanwhile, US-China tensions are heating up. They're butting heads over trade, tech, and even Russia's war in Ukraine.

Last week, President Joe Biden announced an executive order limiting US investments in advanced technology industries in China. The order prompted fund managers to worry about how they should be investing in the country.

What does this mean for me?

When global economic growth slows, that tends to be negative for US equities. Much of that has to do with direct exposure of US companies’ sales in China and with China being a major consumer of commodities.

US firms with deep roots in China might feel the pinch if China's downturn persists. Heavy hitters like Apple, Intel, Ford, and Tesla have big production links there, while brands like Starbucks and Nike bank on the spending power of Chinese consumers.

More News

.webp)

Canada Shields Steel and Lumber Industries From Tariffs

6 hours ago

Trump Drops Selected Tariffs in Response to Inflation Pressures

2 days ago

Tariffs on Mexico Test Nuevo Leon’s Industrial Momentum

6 days ago

US Moves to Ease Latin American Tariffs as Food Inflation Mounts

1 week ago

Japan Faces First GDP Shrinkage in Six Quarters as Tariffs Bite

1 week ago

India’s Inflation Dip Strengthens Case for RBI Easing

2 weeks ago

Europe Rallies as Shutdown Eases, Earnings Impress

2 weeks ago

Germany’s Trade Surplus Slides as Imports Outpace Exports

2 weeks ago